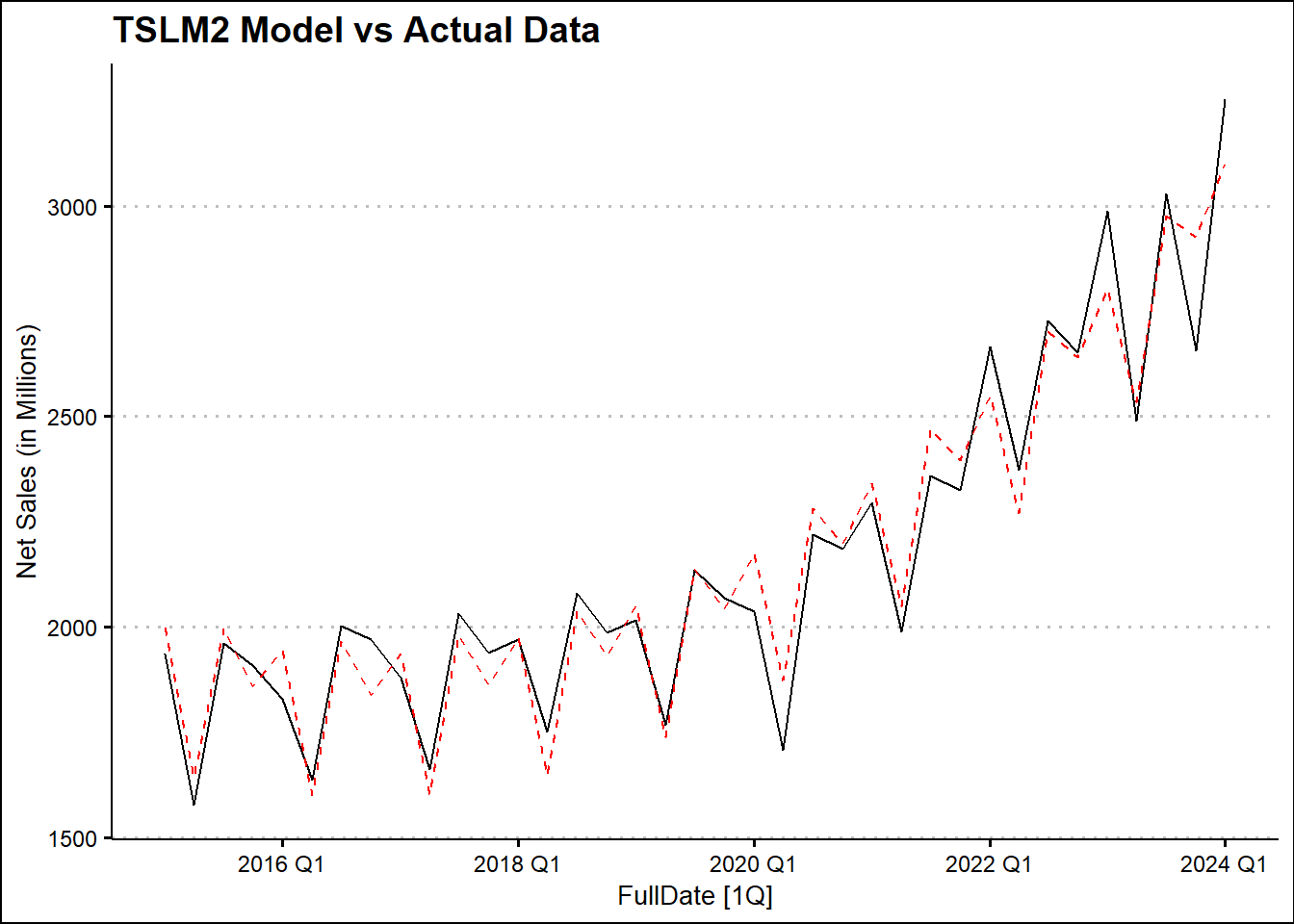

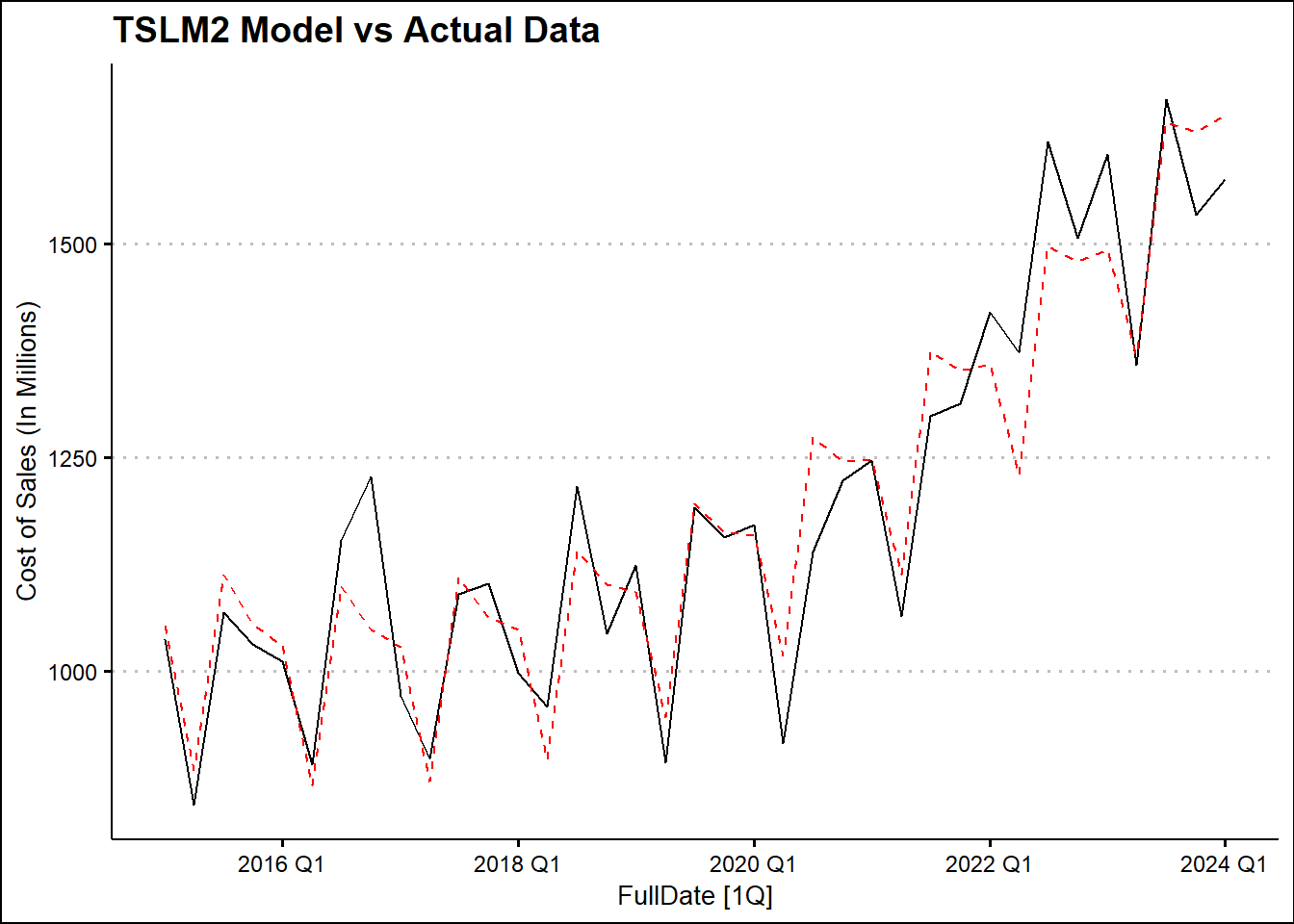

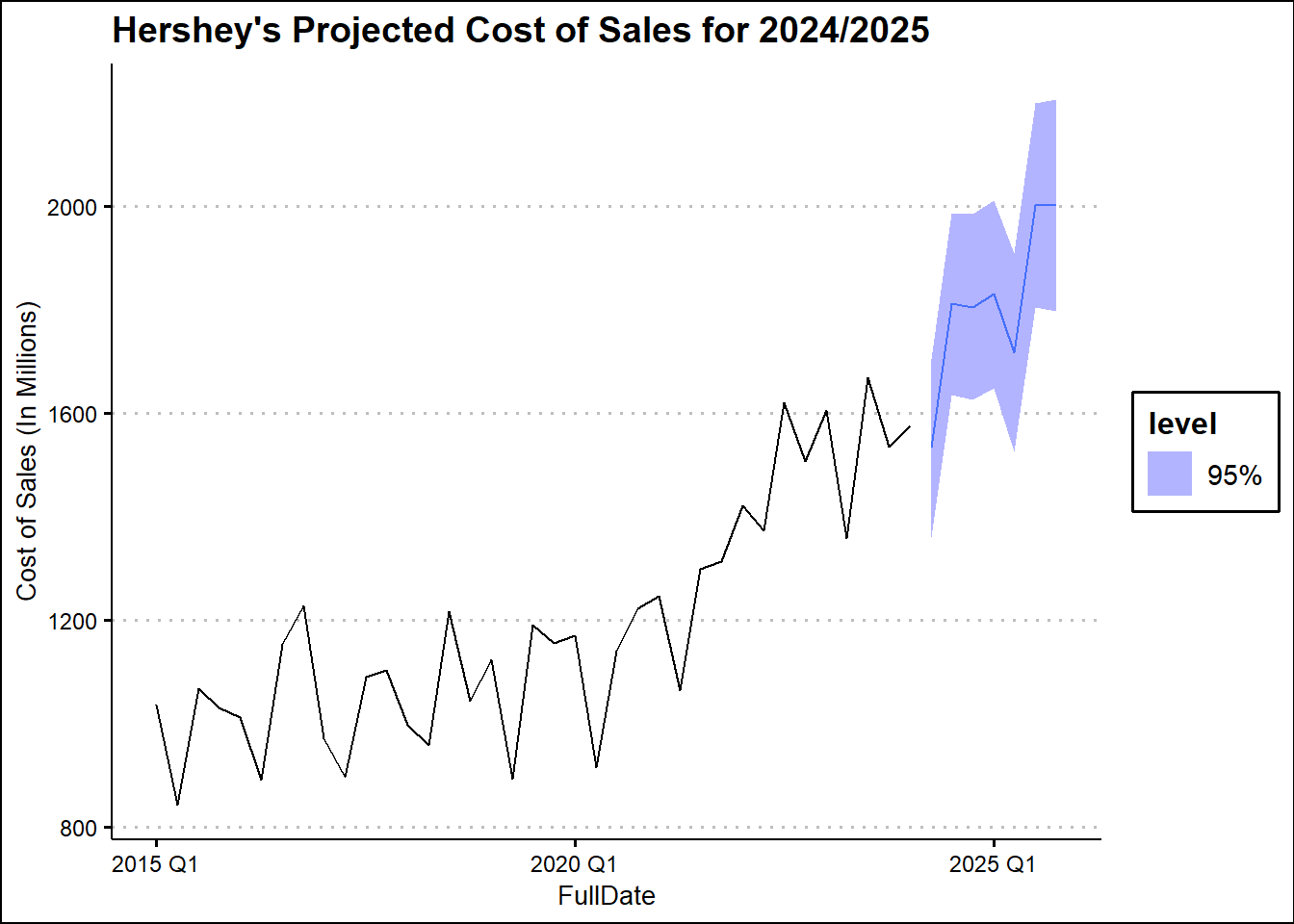

| TSLM2 |

2024 Q2 |

N(1532, 7662) |

1532.371 |

[1360.81323979361, 1703.92967921331]95 |

| TSLM2 |

2024 Q3 |

N(1811, 7983) |

1811.283 |

[1636.16728545879, 1986.39853053419]95 |

| TSLM2 |

2024 Q4 |

N(1805, 8351) |

1805.500 |

[1626.39319352741, 1984.60663056273]95 |

| TSLM2 |

2025 Q1 |

N(1830, 8588) |

1830.267 |

[1648.63322919581, 2011.9012928529]95 |

| TSLM2 |

2025 Q2 |

N(1718, 9559) |

1717.648 |

[1526.01981030487, 1909.27619032919]95 |

| TSLM2 |

2025 Q3 |

N(2002, 10187) |

2002.222 |

[1804.40229056328, 2200.04118645405]95 |

| TSLM2 |

2025 Q4 |

N(2002, 10882) |

2002.101 |

[1797.6417663025, 2206.56029820921]95 |

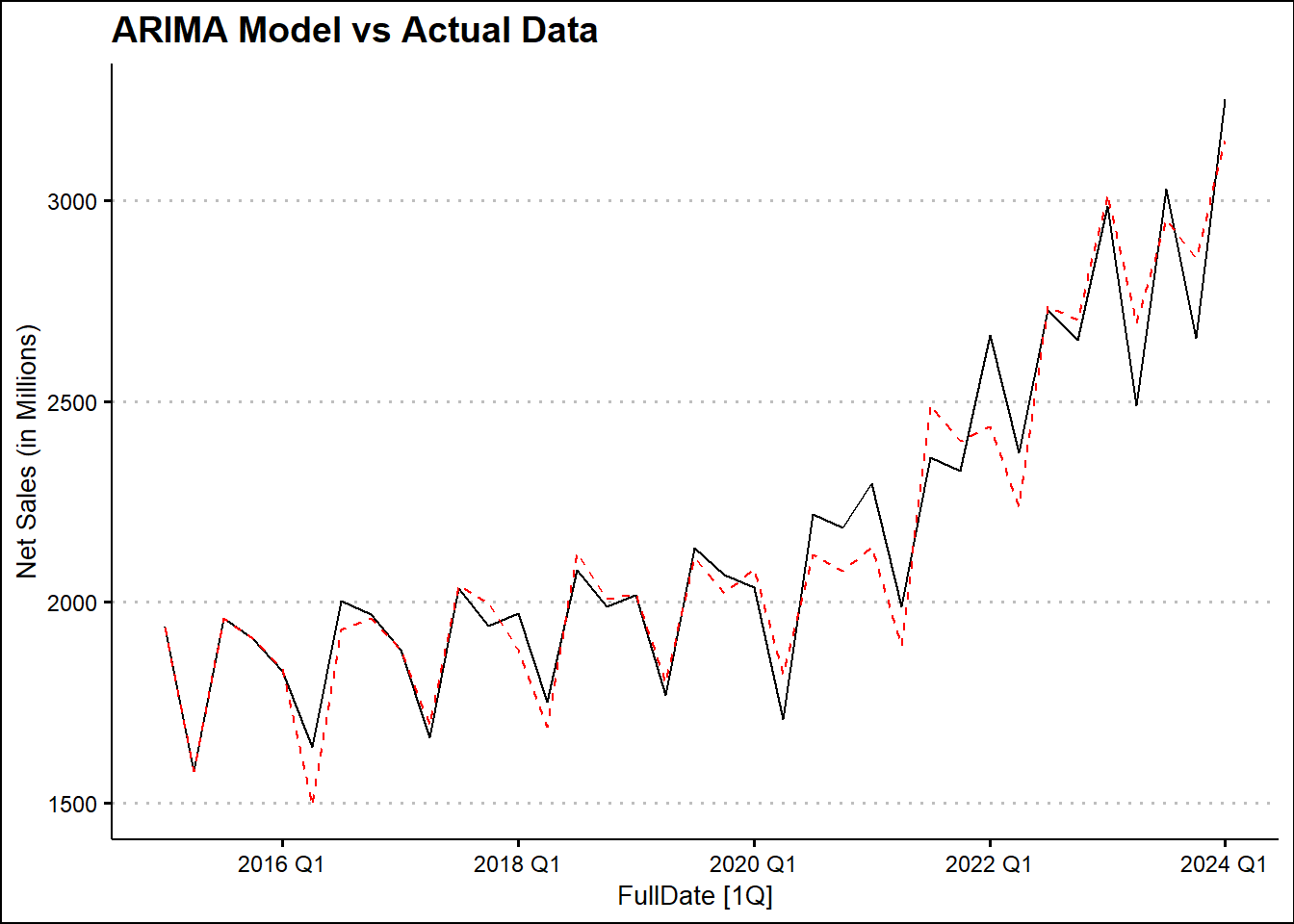

| ARIMA |

2024 Q2 |

N(1394, 7270) |

1394.300 |

[1227.18914028872, 1561.41087024307]95 |

| ARIMA |

2024 Q3 |

N(1651, 8801) |

1650.841 |

[1466.96575863004, 1834.71685349592]95 |

| ARIMA |

2024 Q4 |

N(1594, 11078) |

1594.166 |

[1387.87482549221, 1800.45626744804]95 |

| ARIMA |

2025 Q1 |

N(1617, 12332) |

1617.467 |

[1399.81087588345, 1835.12250481452]95 |

| ARIMA |

2025 Q2 |

N(1446, 14871) |

1445.784 |

[1206.77149974836, 1684.79619287632]95 |

| ARIMA |

2025 Q3 |

N(1700, 16134) |

1700.445 |

[1451.48751500662, 1949.40292240479]95 |

| ARIMA |

2025 Q4 |

N(1647, 17279) |

1646.647 |

[1389.01125651997, 1904.28318437619]95 |

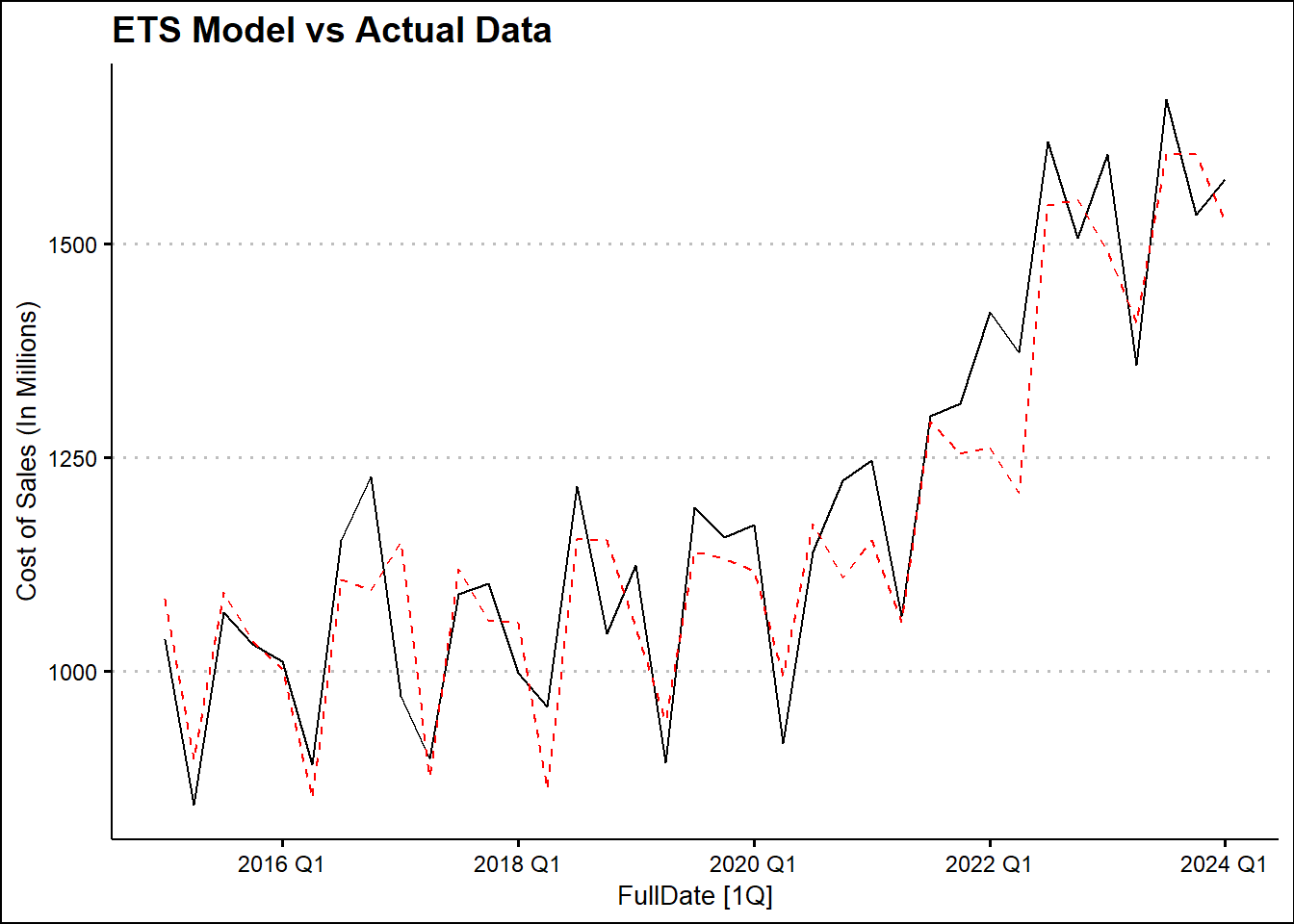

| ETS |

2024 Q2 |

N(1402, 10669) |

1402.412 |

[1199.96390438173, 1604.85974076864]95 |

| ETS |

2024 Q3 |

N(1633, 19024) |

1632.516 |

[1362.18076023152, 1902.85052457189]95 |

| ETS |

2024 Q4 |

N(1591, 24491) |

1590.645 |

[1283.91848901443, 1897.37152846756]95 |

| ETS |

2025 Q1 |

N(1560, 29864) |

1559.750 |

[1221.04389072817, 1898.45683977983]95 |

| ETS |

2025 Q2 |

N(1402, 33024) |

1402.412 |

[1046.23808716779, 1758.58555798259]95 |

| ETS |

2025 Q3 |

N(1633, 41430) |

1632.516 |

[1233.57518788673, 2031.45609691668]95 |

| ETS |

2025 Q4 |

N(1591, 46949) |

1590.645 |

[1165.96604408291, 2015.32397339907]95 |

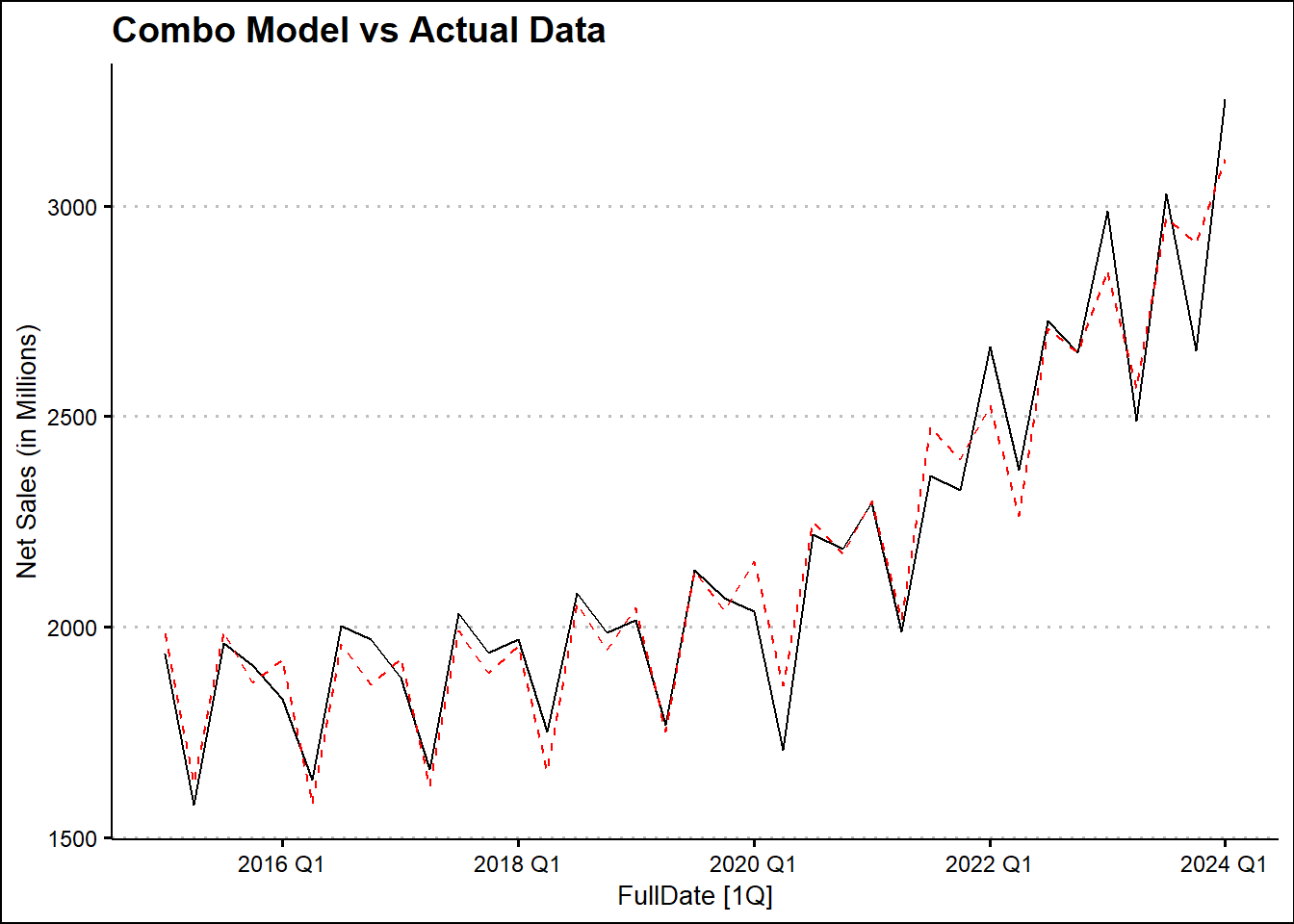

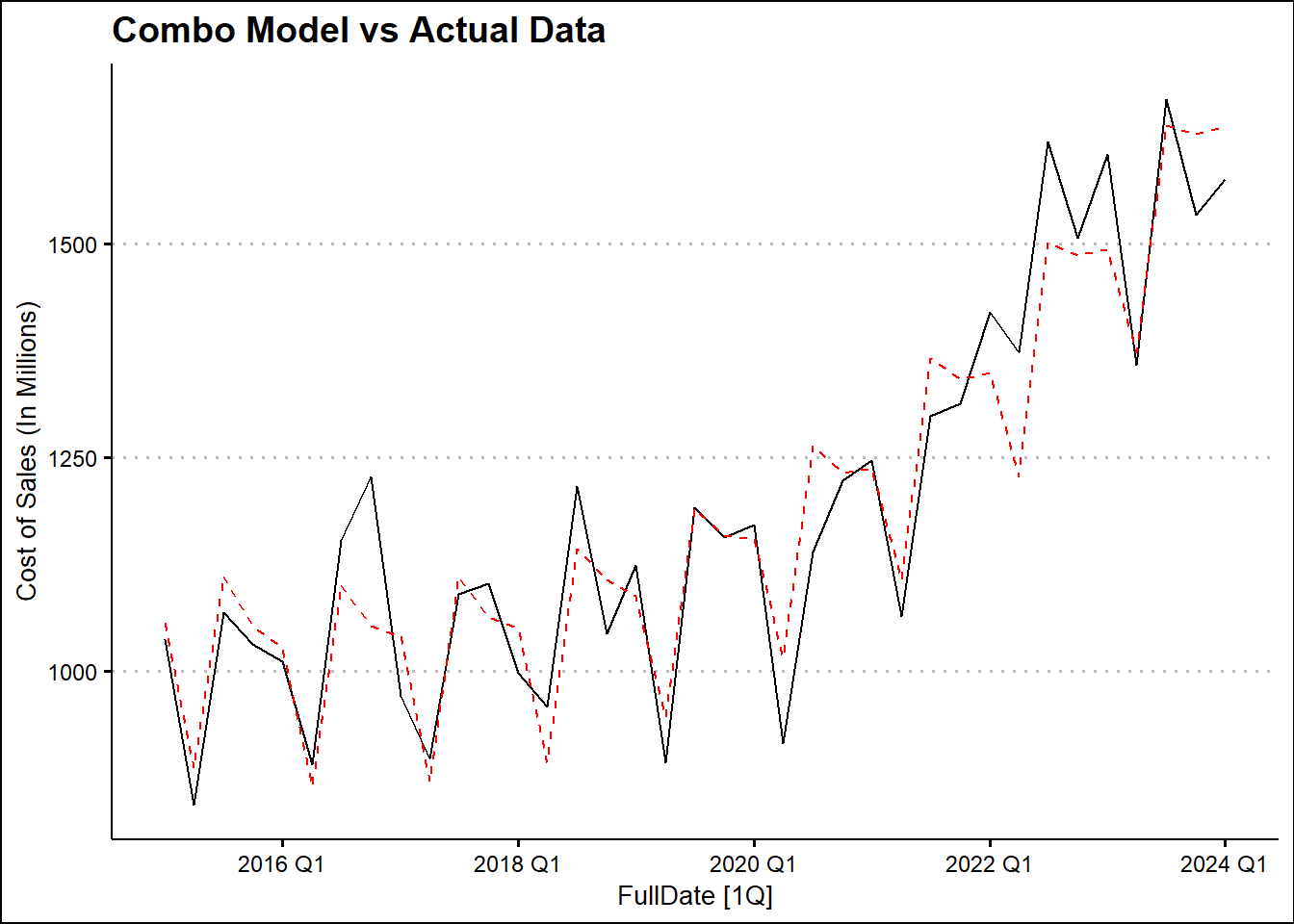

| Combo |

2024 Q2 |

N(1519, 7471) |

1519.375 |

[1349.96741497482, 1688.78357664645]95 |

| Combo |

2024 Q3 |

N(1793, 8235) |

1793.406 |

[1615.54634129935, 1971.26602157467]95 |

| Combo |

2024 Q4 |

N(1784, 8841) |

1784.014 |

[1599.72545894822, 1968.3033844811]95 |

| Combo |

2025 Q1 |

N(1803, 9307) |

1803.216 |

[1614.13699703838, 1992.29414585626]95 |

| Combo |

2025 Q2 |

N(1686, 10349) |

1686.124 |

[1486.73492631119, 1885.51383877451]95 |

| Combo |

2025 Q3 |

N(1965, 11297) |

1965.251 |

[1756.92837847104, 2173.57387932489]95 |

| Combo |

2025 Q4 |

N(1961, 12180) |

1960.955 |

[1744.65155841261, 2177.25930139612]95 |